by Evolving Investment Opportunities

Investable assets are generally defined as those assets which produce cash flows.

“Intrinsic value” of asset represents the present value of future cash flows. Accordingly, stable, predictable and long-lasting cash flows are highly desirable for long-term investment. Despite the Aa3/AA-/A+ (Moody’s/S&P/Fitch) ratings, 20 year JGB yields far less than equivalent US Treasury or German Government Bond yields. It is our goal to achieve higher cash flow returns than the 20 year JGB yield with limited risk for impairment through long-term contractual cash flows.

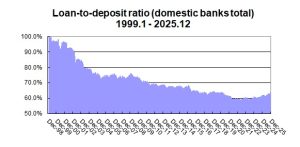

Due mainly to the Basel II/III bank capital requirements, Japanese banks are taking less risks on the assets they hold, consequently creating various opportunities created by non-presence of banks including loans to heavily indebted companies, real estate loans, ship financing or project financing. We fully utilize the purchasing power of cash to obtain assets at a favorable discount and maintain full recourses to the borrower as well as to the underlying assets, where possible.

*refer to “Loan-to-deposit ratio (domestic banks total)” below

Cash flow strategies based on long-term contracts or other contractual opportunities and yield well above 20 year JGB yield could include the followings:

Core cash flow strategies with 4 – 5 % expected returns in JPY

Sale and Lease-back: Obtains a profitable store/facility from a company in need of financing for further growth. In order for the financee/tenant to repurchase the assets at the expiration of the contract, its intentions are to acquire assets the company would not like their competitor to acquire.

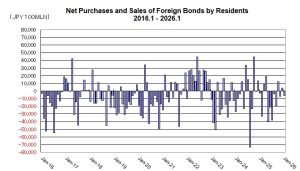

*refer to “Net Purchases and Sales of Foreign Bonds by Residents” below

Land lease contract: Acquires only the land from a profitable store/facility and maintains the long-term land lease contract. The present value of the asset (valuation of land owned) will not change.

Equity investment in real estate: Fully utilizes the purchasing power of cash (without debt arrangement) and obtains a yielding asset at a discount while improving in order to realize higher rents.

Opportunistic cash flow strategies with 10 % or higher expected returns in JPY

Real estate distressed debt: Obtains assets from non-Japanese companies (typically investment banks or consumer finance companies) trying to exit from Japanese markets or troubled domestic financial institutions/asset managers/developers/private real estate funds. The assets are typically discounted prices, and HC will collect the money from debtors (not by selling the assets) over the years. Running yield will be maintained by the rents from assets.

Small/Mid-Market Finances: Due to higher risk weight or concentration, banks tend to avoid Energy-related, Shipping, Real Estate or Small/Mid Market lending. In the absence of banks, there could be opportunities for alternative finances with ample spreads .