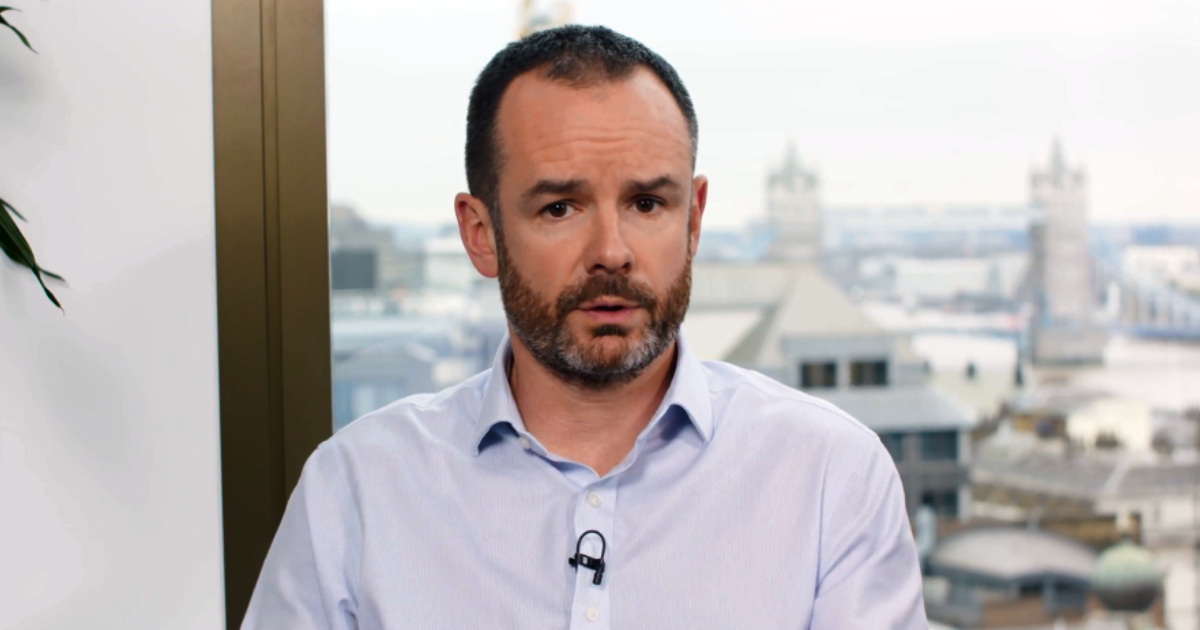

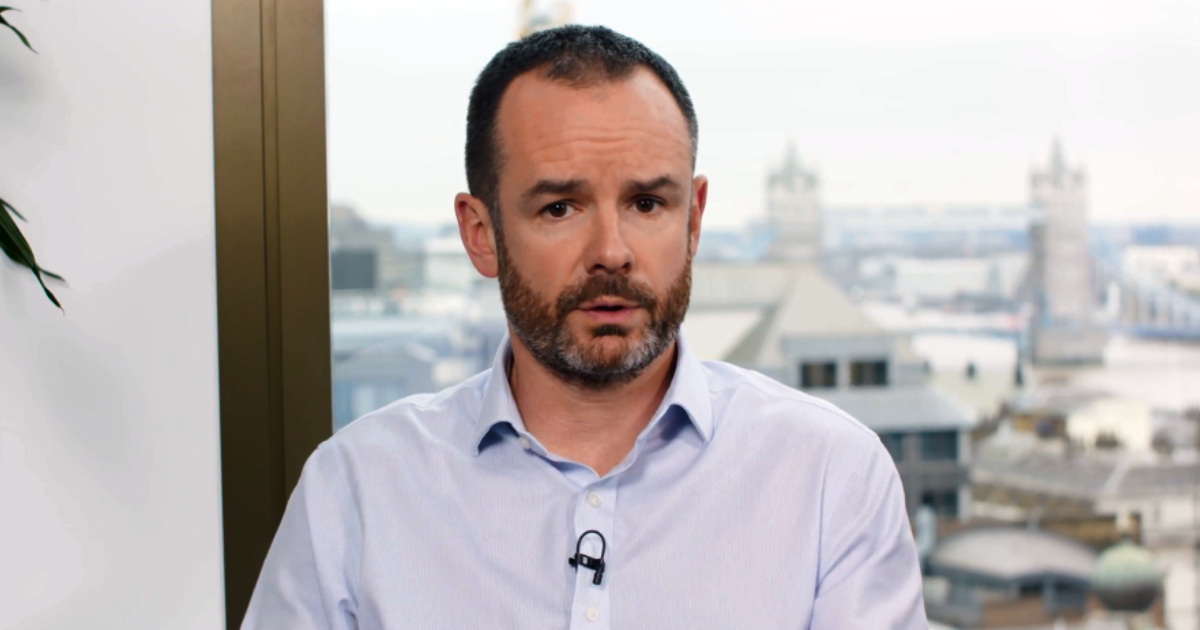

Ben Hayward

- Classification

- Debt/Bond

- Company

- TwentyFour Asset Management

Ben is one of the founding partners of TwentyFour and a Portfolio Manager. He is a member of the firm’s Executive Committee which has the overall responsibility for the day to day running of the business.

Ben’s main responsibility is managing the ABS business, having launched several strategies that invest into a diversified range of European and Australian asset-backed securities (ABS) across the credit spectrum.. He is a member of the Investment, Risk & Compliance and Product Governance Committees.

Ben has 21 years of fixed income portfolio management experience, having spent nine years at Citigroup Alternative Investments, where he was responsible for managing four vehicles that invested $100bn across ABS and credit.

TwentyFour is a specialist fixed income investor whose funds are focused on the areas of fixed income where we believe we can extract most value for our clients. ABS is one of these areas; it remains largely an under-researched and poorly understood asset class, meaning those that put in the effort and expertise can be well rewarded.

The investment approach is active, research-based and high conviction. We devote a large amount of time and resources to due diligence – meeting issuers, loan servicers and collateralised loan obligation (CLO) managers, as well as forensic internal modelling of transactions. TwentyFour is one of the few managers that invests across the spectrum of European ABS products, which we feel gives us not just critical insight into liquidity and relative value across the market, but also can bring greater influence over the structure and pricing of transactions.

We believe there are a number of attractive opportunities in the ABS market today, aided by the spread widening seen across the global credit market towards the end of 2018.

While ABS spreads have started to tighten from the wides we saw amid the volatility of November and December, they have not retraced anywhere near as much as corporate bonds and leveraged loans. That lag in performance can be partly attributed to the lack of primary issuance so far in 2019. Investors could do with a sense of direction from seeing subscriptions levels on new benchmark-type deals. So while spreads are still cheap compared to recent years, we feel more trades in the primary market would give the market direction and may reduce the relative value opportunity rather quickly.

Over the course of 2019, we expect that naturally as the credit cycle matures investors will seek the greater comfort in higher quality deals, something we are already starting to see in the CLO market. We favour focusing on stronger credit quality investments, with a heavy focus on structuring solidity and shorter credit duration assets, with enhanced liquidity to take advantage of any further spread widening. We expect to maintain a low exposure to euro-denominated consumer ABS, a part of the market where yields have been pushed down by the European Central Bank’s asset purchase programme to a point where we believe they are extremely unattractive.

I didn’t initially plan on being a portfolio manager, but joined an alternative asset manager in an operational role having spent a year as a trainee accountant. When the opportunity arose to move into an investment role, I was principally attracted by both the requirement to position portfolios for macro outlook, market technicals, relative value and so on, but at the same time to look deeply into the underlying credit risk of each individual position.

At TwentyFour, our number one priority is to deliver performance for our clients. However, we are always mindful of the unwritten rule of fixed income, which is capital preservation at all times.

As ABS portfolio managers, it is our responsibility to scrutinise the collateral, structure and issuer of every transaction we consider on behalf of our clients.

Before even considering capital appreciation, we devote a huge amount of time to researching the loan-level data available for each transaction. Due to the transparency of ABS collateral pools, we can have strong conviction in our ability to accurately model risk.

Proper due diligence also involves regular meetings with the issuer or manager responsible for structuring the trade, in order to be certain that it will perform as we expect and return capital at maturity.

We underwrite every investment on the basis of holding it to maturity. What we would never do is make an investment in the hope that its value would rise in the short term, with a view to selling before its performance deteriorated.

It is also important to ensure that the liquidity profile of our portfolios matches the wrapper and clients’ requirements, something not enough managers pay attention to in our view.

We operate with a mentality where we are always looking for things that could go wrong, a pessimistic view which strengthens our approach of underwriting every position to maturity. Making this the core of our investment process has proven to be an effective way of mitigating default risk.

Therefore, the thorough due diligence we carry out on each transaction is our best way of protecting clients’ assets. Since the transactions are backed by pools of loans, and data is available on each of these loans, investors are better able to model and track the performance of the assets and ensure they are confident of getting their principal back at maturity.

TwentyFour’s ABS team has a lot of sell-side experience, which we feel gives us an edge over our rivals when it comes to managing short term technical market forces, which are a potential driver of poor mark-to-market performance.

Built-in protections for bondholders, such as credit enhancement, loss-absorbing reserve funds and the legal separation of issuers from their asset pools, are attractive features of ABS that help us with this goal.

I favour books that are less of a formal text book and also less to do with my part of the investment universe, so I can see what other businesses have experienced, and there are lots of great books in this category; When Genius Failed and Liars Poker are two favourites. Recently I have really enjoyed Bad Blood (to emphasize the importance of really in-depth due diligence – a process I value highly), and The Essays of Warren Buffet (a compilation of his letters to Berkshire Hathaway’s investors).

As ABS specialists, it can sometimes be frustrating to read coverage of the ABS and CLO markets in the mainstream financial press. There remains a lack of understanding in some quarters over what role securitisation did or did not play in the 2008 financial crisis, meaning there remains an unfair stigma attached in particular to European ABS, which suffered barely any principal losses even through the crisis.

We are very keen readers of central bank lending surveys, such as the Bank of England’s excellent Credit Conditions Survey, and other relevant industry reports, which give us crucial insight into the outlook for loan performance and the activity of banks and other lenders.

There are a number of sources we use to keep in touch with broader market events, such as Bloomberg, the Financial Times and the Wall Street Journal, as well as more market-focused trade publications such as Reuters’ International Financing Review, GlobalCapital and Structured Credit Investor.

TwentyFour Asset Management is a specialist fixed income investor and boutique of the Vontobel Group, headquartered in the City of London. Since inception in 2008, it has built a strong reputation in Europe for performance, expertise and innovation in the bond markets.

Its product offerings are for both professional and institutional clients, covering open-ended funds, closed- ended funds and segregated mandates, with many tailored in particular specifically to the needs of pension schemes. TwentyFour’s portfolio management teams cover three distinct business areas – Multi-Sector Bonds, Outcome Driven and Asset-Backed Securities – while working closely together.

The firm’s goal is to provide investors with superior risk-adjusted returns, with a strong focus on capital preservation throughout the economic cycle. It is a fixed income specialist – it is the only asset class they buy. All of TwentyFour’s resources and people are trained on delivering the best outcomes for its clients in its chosen sector.

TwentyFour’s investment grade asset-backed securities (ABS) strategy invests across the full spectrum of European ABS markets, using the natural advantages of the asset class and a vastly experienced team to target stable, attractive returns. The overall objective is to provide investors with an attractive level of income over prevailing interest rates, with a strong focus on capital preservation.

The strategy is designed to capture the built-in advantages ABS holds over more mainstream investment options like investment grade government or corporate bonds. ABS have tended to offer a higher yield for a given rating or maturity than these sectors, and they are virtually all floating rate, meaning they are expected to be far less volatile than fixed rate bonds in periods when interest rates are rising. ABS also feature built-in investor protections such as credit enhancement, loss-absorbing reserve funds and the legal separation of issuers from their asset pools.

April 1, 2019

by Investment in Japan