(New) Yoshihiko Ito

- Classification

- Equity

- Company

- Nippon Value Investors

Yoshihiko (“Yoshi”) Ito started his career in the asset management field in the late 1980s. In the mid-1990s, as a trainee investment manager at Silchester International Investors in London, he learned value investing based on the fundamentals of individual companies. Yoshi then used the value-investment philosophy and approach to invest in Japanese equities at a large Japanese investment management firm. He established Nippon Value Investors with his colleagues in 2005. Since then, Yoshi and his colleagues, who had worked together at this Japanese investment management firm since 1999, have been implementing the value philosophy and approach of identifying and investing in undervalued companies in the Japanese equity market. Yoshi is a graduate of Tokyo University of Foreign Studies and earned his master's degree in Finance at London Business School. He is a chartered member of the Securities Analysts Association of Japan.

Nippon Value Investors' (NVI’s) Japanese equity investment program aims to achieve excess returns over the medium- to long-term by investing in temporarily undervalued stocks in the Japanese stock market using a bottom-up approach based on its value investment philosophy. To achieve this goal, NVI aims to increase the portfolio’s intrinsic value over medium- to long-term by adhering to its price discipline and periodically re-allocating funds to stocks that have more attractive valuations.

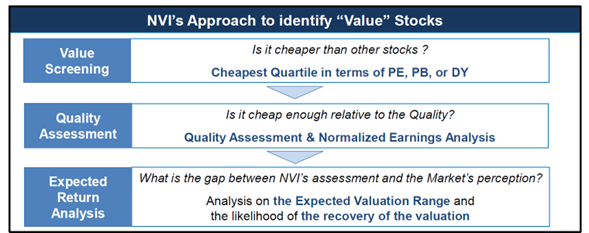

NVI's investment philosophy is anchored in the theory that undervalued stocks outperform the market average, which is derived from the results of a backtest covering more than 40 years. However, NVI does not believe that all low-valuation stocks can be attractive investment opportunities. NVI recognizes that some of these stocks may have vulnerable business foundations, weak financial conditions, or ineffective management. Therefore, in its value investment approach, NVI emphasizes not only the low valuation of a company’s stock, but also the quality of the companies. In other words, for NVI, an attractive investment opportunity is a relatively low-valuation stock of a company whose business is considered to be strong in various aspects, such as the business foundation, financial condition, and management capabilities.

Therefore, NVI first screens stocks that are traded at relatively low valuations and then uses in-depth research to evaluate the quality of these companies. Investment decisions are made when the stock is considered to be undervalued in relation to the quality of the company. By periodically adjusting the size of the portfolio holdings based on the relative attractiveness of each investment opportunity, NVI aims to consistently maintain a portfolio consisting of stocks that are considerably undervalued.

Since its inception in 2006, NVI’s investment program has been managed by experienced investment professionals (six professionals as of the end of 2023) as a team. They build a model portfolio based on the value investment philosophy and bottom-up process and manage the Japanese equity investment program in a consistent manner.

NVI's investment philosophy revolves around the idea that value investing is paying an attractive price relative to the quality of the business one intends to own.

To assess whether an investment candidate company is traded at an attractive price, NVI uses three key valuation ratios: PER (Price-to-Earnings Ratio), PBR (Price-to-Book Ratio), and dividend yield. NVI calculates the PER based on a company’s normalized earnings, which are estimated by NVI and are considered to be sustainable over the medium- to long-term, instead of a company’s past or forecasted earnings.

Results from the backtest on the Japanese stock market indicate a tendency for companies in the cheapest quartile (25%) in terms of the three valuation ratios (rebalanced annually at year-end) to outperform the overall Japanese stock market over the medium- to long-term period.

Based on these backtest results, NVI initially identifies candidate stocks by screening those that fall within the cheapest quartile (25%) in at least one of the three key valuation ratios.

However, recognizing that not all stocks with low valuations are necessarily undervalued stocks with the potential for superior returns, NVI thoroughly analyzes the quality of potential investment candidates. This analysis aims to avoid falling into a value trap, where a stock may appear cheap but has underlying quality issues.

NVI's ideal investment candidates are companies that have relatively low valuations and are undervalued relative to their quality based on NVI’s research. NVI evaluates the quality of investment candidates primarily from the perspectives of the company's business foundation, financial condition, and management capabilities.

Based on these quality assessments, NVI conducts expected return analysis for individual stocks to determine the overall attractiveness of stocks as an investment candidate. This analysis incorporates NVI's assessments of valuation and quality for each stock, the market's perception gap, and the likelihood of a recovery in the valuation of those stocks. If NVI determines that a stock is undervalued, overlooked by investors, and considered to be an attractive investment, NVI adopts a contrarian approach as a rational investor and gradually increases its holding.

Actually, it was by chance that I ended up working in the investment management industry. My first job involved in the management of foreign bond investments and foreign exchange trading at an agricultural and forestry-related financial institution. Through trading in response to the fluctuations of interest rates and exchange rates because of various macroeconomic factors in different countries, I experienced the excitement of managing funds for the first time.

Several years later, I moved to a life insurance company and worked in investment operations, including European equity management, at its London subsidiary. The investment approach used at that time was top down, based on macroeconomic analysis of each country, to determine asset allocation and industry allocation and select individual stocks. During that period, 80% of the investment performance was said to be derived from successful asset allocation. Individual stock selection, which was at the very end of the process, was not considered to be an importance source of performance.

In 1996, while working at the London subsidiary, I was assigned to work at Silchester International Investors, a company based in London that conducts international equity investments based on a value philosophy, for a one-year training program. Silchester’s investment process was a complete bottom-up approach without macroeconomic analysis and started with individual stock selection. This was a radical shift from the methods I had used until then and it was truly a revelation to me. I personally, as well as my team at the life insurance company underwent a complete conversion to the bottom-up approach. Subsequently, in 2005, with two of my colleagues, we established Nippon Value Investors. Now, as a team of six investment professionals, we continue to use the bottom-up approach based on the same value philosophy as we focus on individual stock selection.

As portfolio managers, there are several principles that we consistently adhere to:

-The medium- to long-term performance of the portfolio reflects the growth of the portfolio's intrinsic value.

-The growth of the portfolio's intrinsic value is achieved through the rotation of portfolio holdings to stocks at more attractive valuations (which include more earnings, assets, and dividends per investment unit) and the organic growth of the earnings, assets, and dividends of the portfolio companies.

-This is why, regardless of short-term market conditions (such as the performance of specific sectors), we should focus on individual stock selection and portfolio management based on the bottom-up approach to enhance the intrinsic value of the portfolio over the medium- to long-term to achieve our primary objectives.

All six members of NVI’s team of investment professionals adhere to these principles. When we determine that a company is undervalued or overvalued relative to its quality, we make a decision to buy or sell the stock to enhance the intrinsic value of the portfolio in accordance with our price discipline without being swayed by short-term factors.

Our ultimate strategy for asset preservation is to invest in stocks that are sufficiently undervalued to avoid the risk of permanent loss of capital. To achieve this, we meticulously analyze the quality and valuation of individual stocks and make a concerted effort to avoid investing in stocks where the valuation is not sufficiently low relative to their quality. Additionally, we manage the risk of portfolio concentration based on certain risk factors, including sector exposures, to avoid excessive concentrations.

Events such as the 2007-2008 Global Financial Crisis, the 2020-2022 COVID-19 pandemic, and the Ukraine war that began in 2022 are instances where a major crisis had a profound impact on corporate performance. Such events typically have substantial repercussions in the stock market over a period of 2-3 years. However, in these situations, we believe it is crucial to maintain a medium to long-term perspective and capitalize on the medium to long-term opportunities arising from short-term crises. Therefore, we base our investment decisions on a time horizon of approximately 3-5 years to ensure that we don't lose sight of our view using a long perspective while navigating short-term crises.

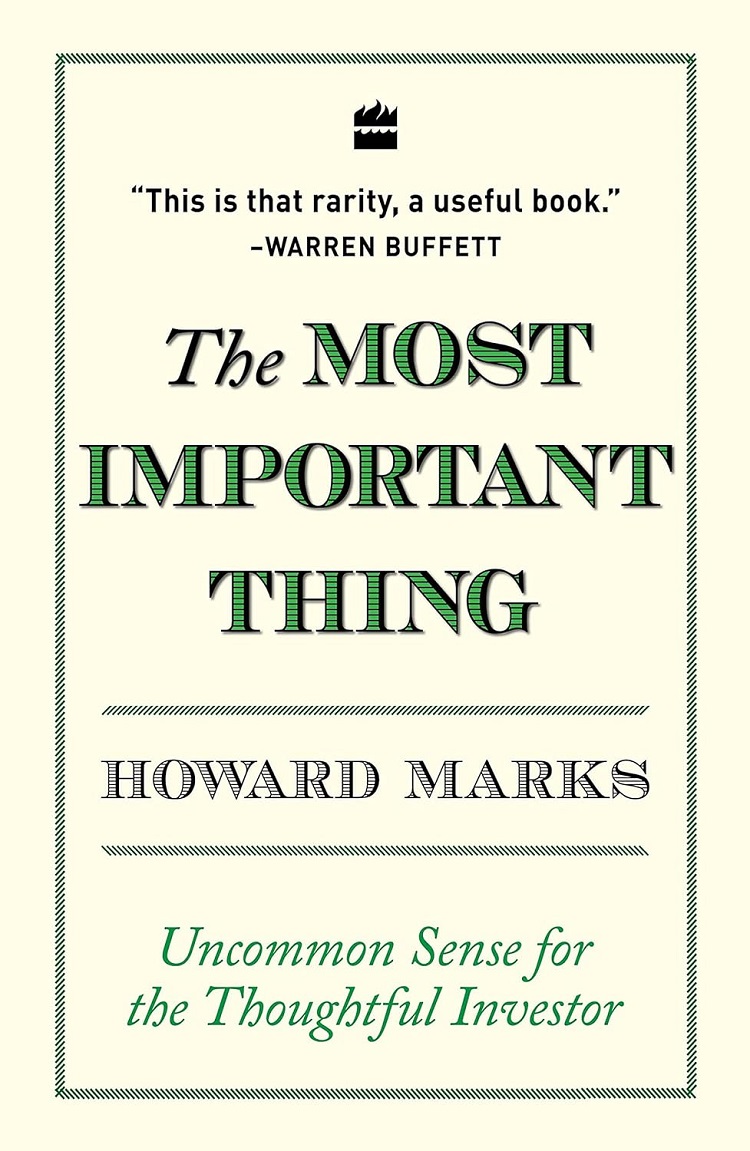

I recommend The Most Important Thing by Howard Marks, who is the Chairman and Co-Founder of Oaktree Capital Management, a leading investment firm in the United States. This book, published in 2012, is a compilation of excerpts from newsletters that Mr. Marks sent to clients over the past 20 years. The book explains how Mr. Marks perceived and responded to various changes in the investment environment. The book is replete with insights aimed at helping us as investors retain our rational decision-making abilities amidst market fluctuations.

As an investor in the Japanese stock market, my primary source of information is the Nikkei Shimbun, especially its electronic version because articles are available nearly on a real-time basis. I also regularly use sources such as Toyo Keizai, Weekly Diamond, and Nikkei Business to stay informed about trends in industries and major companies. Additionally, to delve deeper into global events or to gain insights from foreign perspectives on Japan, I rely on media outlets like the Wall Street Journal (including the Japanese edition), Financial Times, and Economist.

Lately, with internet web browsers offering instant translation features that make English articles reasonably comprehensible in Japanese, I have noticed that the language barrier for English media has significantly diminished. This technology makes it easier to access and understand articles in English, contributing to a more seamless flow of information across language boundaries.