by Noriyuki Morimoto

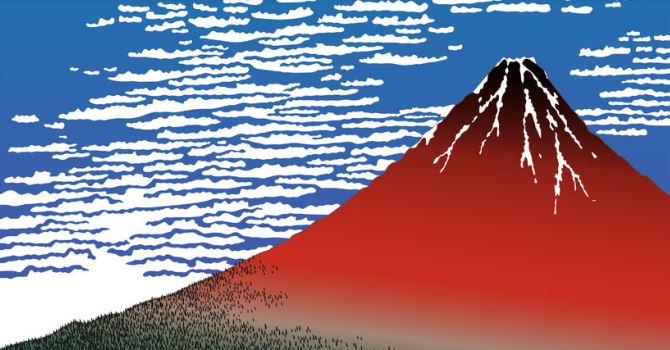

It is well known that Japanese ukiyo-e woodblock prints had a strong influence on the history of French art. Ukiyo-e is said to have arrived in France as wrapping paper for exported porcelain. Ukiyo-e was mass-produced in Japan during that time, apparently making it commonplace enough to be reused as wrapping paper. However, in France, it was valued as rare works of art, full of fresh and stimulating aesthetic quality.

The position of ukiyo-e in today’s global art market has been established by foreigners who discovered its value. Of course, ukiyo-e was created by the Japanese. However, the value of ukiyo-e was not established by the Japanese, who made the works, but the French, who discovered its worth.

The price of ukiyo-e set by Japanese people in the past was probably a fraction of that set by their French contemporaries. Today, however, we have no choice but to trade the same piece of ukiyo-e at the same price, whether you are French, Japanese, or of any nationality. This is the result of global integration of the art market.

Over many years, different prices based on two different sets of values have converged into one price based on one perception. It is a matter of course that this period saw a significant outflow of ukiyo-e from Japan, where its price had been low, to the outside world, which valued it higher. The principle of trade works in this way. Traders involved in ukiyo-e probably made profits, but almost all of the gains were on the side of the French buyers, not the Japanese sellers.

Chinese merchants searched for sea cucumbers all over the world, Europeans crossed the world’s oceans in pursuit of pepper, and many other peoples, with each of their perceptions, explored values not found in their home country. This movement gave rise to international trade and further led to the creation of today’s global economy. Sea cucumbers and pepper had not held much value in their places of origin: their values were created by foreigners who came from outside and discovered them.

French merchants discovered ukiyo-e and profited from its value; likewise, those who made profit from sea cucumbers and pepper were foreign traders who discovered them. This principle probably applies to all trading businesses that exist from ancient times.

One origin of investment that leads to this day is the traditional act of funding trade. As traders were unable to cover the costs of purchasing merchandise and chartering vessels only with their own capital, they required external funds. Thus investment can be said to have originated from discovery of value rather than creation of value. Of course, we cannot call it an investment if you do not invest in the side that makes profit.

Chief Executive Officer, HC Asset Management Co.,Ltd. Noriyuki Morimoto founded HC Asset Management in November 2002. As a pioneer investment consultant in Japan, he established the investment consulting business of Watson Wyatt K.K. (now Willis Towers Watson) in 1990.